Navigating The Complex World Of Bookkeeping

Our expert team has compiled a series of helpful tips and advice to help you manage your finances effectively. From understanding tax implications to streamlining your accounting processes, our resources are designed to empower you to make informed decisions. Whether you're a seasoned business owner or just starting out, our bookkeeping tips will help you stay organized and achieve your financial goals.

Business Guidance - Fact Sheets

We’ve created a series of informative fact sheets to help you navigate the complexities of running a business. From setting up your business to understanding your tax obligations, our fact sheets cover a wide range of topics. Whether you’re a sole trader or a limited company, we’ve got you covered. Click on the left to head to the fact sheets and download for free.

Running A Business-Top Tip!

Keep Your Business and Personal Finances Separate:

Using a separate business bank account makes it easier to track income and expenses, reconcile your accounts, and prepare your taxes. It also provides a clear financial overview of your business's performance. By separating your personal and business finances, you can avoid confusion and ensure accurate record-keeping.

Sole Traders vs. Limited Businesses:

What's the Difference?

Sole Traders and Limited Businesses operate differently in terms of legal structure, tax obligations, and financial responsibilities:

Sole Traders: Operate as individuals, meaning you and your business are legally the same entity. Profits are taxed as personal income, and you're personally liable for any debts. This structure is simple and ideal for small, low-risk ventures.

Limited Businesses: Are separate legal entities, protecting personal assets from business liabilities. They have more reporting requirements and are taxed on profits through Corporation Tax. This structure suits larger or growing businesses needing a professional appearance or investors.

At Cashtrak, we provide tailored bookkeeping, tax preparation, and payroll services for both sole traders and limited businesses. Whether you need help with self-assessment tax returns, managing VAT, or filing statutory accounts, we simplify your financial processes so you can focus on your business. Let us handle the numbers while you drive success!

Find our in depth factsheets on sole trader or limited company here.

Why Outsource Your Bookkeeping?

Outsourcing your bookkeeping to Cashtrak means more time for you to focus on growing your business while leaving the numbers to the experts. Here are the key benefits:

Cost-Effective: Save on hiring, training, and maintaining in-house staff.

Expertise: Access professional, experienced bookkeepers who stay updated on the latest regulations.

Accuracy & Compliance: Ensure your financial records are error-free and compliant with tax regulations and laws.

Scalability: As your business grows, we adapt to meet your changing needs.

Peace of Mind: Rest easy knowing your bookkeeping is in reliable hands.

At Cashtrak, we streamline your financial processes, giving you the clarity and confidence to drive your business forward. Let us handle the books while you focus on success!

Benefits Of Outsourcing To Cashtrak

Same cost every month

Seamless sickness & holiday cover

Reduce errors

Increase accuracy

Full scalability as business grows & evolves

Concentrate on your business while we deal with your bookkeeping

With nearly 20 years of experience, we bring a wealth of knowledge and time-saving strategies to your business.

In House Bookkeeping Problems

Varying employee costs (wages, National Insurance etc.)

Staff training costs

Cost (time or financial) of covering training, holiday & sickness

Outdated knowledge on regulations

Time and resources for recruitment & ongoing staff management

May be more likely to overlook errors or make biased decisions

What is VAT?

Value Added Tax (VAT) is a consumption tax added to the price of most goods and services.

Businesses registered for VAT charge VAT on sales and reclaim VAT on purchases.

VAT Registration: To register for VAT, your business's taxable turnover must exceed the VAT threshold.

Once registered, you'll need to submit VAT returns periodically, usually quarterly or monthly.

VAT Returns: VAT returns involve calculating the VAT you've charged on sales and the VAT you've paid on purchases. You'll need to submit these returns to HMRC on time.

VAT Schemes:

There are various VAT schemes available, including:

Standard-rated VAT: Most goods and services are subject to standard-rated VAT, currently 20%.

Reduced-rate VAT: Certain goods and services, such as domestic fuel and energy, are subject to a reduced rate of VAT.

Zero-rated VAT: Some goods and services, such as food, children's clothing, and books, are zero-rated.

Exempt Supplies: Certain supplies, such as financial services and healthcare, are exempt from VAT.

Watch Our Video For More On VAT

What is VAT

VAT threshold

Compulsory registration

Advantages and disadvantages of voluntary registration

Tricky VAT rates

VAT schemes

Guidance for Businesses Employing for the First Time - New Employers

Hiring your first employee is an exciting milestone, but it comes with new responsibilities. Here’s what you need to know:

Register as an Employer: You must register with HMRC before paying your employee.

Set Up Payroll: Use a compliant system to calculate wages, taxes, and National Insurance.

Contracts & Policies: Provide a written employment contract and ensure workplace policies meet legal standards.

Pension Contributions: Auto-enrol your employee into a workplace pension if they’re eligible.

Stay Compliant: Keep accurate records and stay updated on employment laws.

At Cashtrak, we guide you through every step, from payroll setup to compliance. Our expert services ensure your business is ready to hire and thrive—stress-free. Let us help you make a strong start as an employer!

Payslips

Understanding Your Payslip: Tax Codes and Your Responsibility

Your payslip is more than just a record of your pay—it’s a key document that provides insights into how your income is taxed. One important element to pay attention to is your tax code, which determines how much income tax is deducted from your wages.

What is a Tax Code?

A tax code is a combination of numbers and letters assigned by HMRC to indicate your personal allowance and tax situation. It helps your employer or pension provider calculate the correct amount of tax to deduct from your income.

Example Tax Code: 1257L

The number (e.g., 1257) represents your tax-free personal allowance, divided by 10.

The letter provides additional information about your tax situation. For example:

L: Standard tax code for most taxpayers.

BR: All income taxed at the basic rate (often used for second jobs).

D0: Income taxed at the higher rate only.

Our video looks at what your payslip shows and what some of the tax codes mean.

Who is Responsible for Checking Your Tax Code?

Ultimately, it’s your responsibility to ensure your tax code is correct. Mistakes can lead to overpaying or underpaying tax.

What You Should Do:

Check your tax code on every payslip. If it looks unfamiliar or changes unexpectedly, investigate further.

Compare your tax code to your personal situation. For example:

Are you receiving the right personal allowance?

Have you started a new job or received additional income?

Notify HMRC if you believe your tax code is incorrect or if your circumstances change.

Employer’s Role:

Your employer is responsible for using the tax code provided by HMRC to calculate your tax. They cannot change your tax code unless instructed by HMRC.

Why Your Tax Code Matters

An incorrect tax code can impact your take-home pay and future tax liabilities. Staying proactive ensures:

You’re paying the correct amount of tax.

You avoid surprises when completing your self-assessment or reconciling taxes with HMRC.

How Cashtrak Can Help

At Cashtrak, we’re here to simplify the complexities of payroll and tax codes. Our payroll services ensure that your payslips are accurate and compliant with HMRC regulations. Whether you’re an employer looking to streamline payroll or an employee needing guidance, we provide clear explanations and expert advice.

Stay informed and confident about your tax obligations with Cashtrak by your side. Contact us today to learn more about our payroll and bookkeeping services!

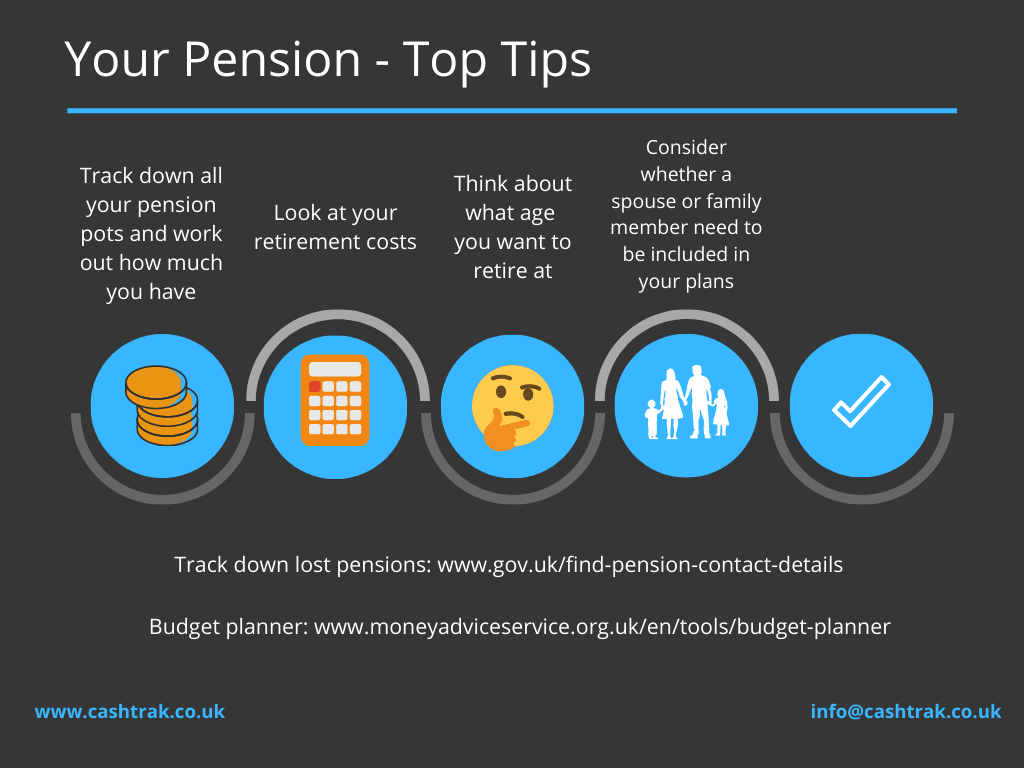

Pension Management

Managing workplace pensions is a legal requirement for all employers under the Pensions Act 2008, but navigating the regulations can be complex. At Cashtrak, we simplify the process by:

Ensuring Compliance: We keep you aligned with The Pension Regulator’s requirements, so you avoid fines and penalties.

Suitable Providers: We help you choose a pension provider that balances low administration costs with high-quality service.

Streamlining Administration: From auto-enrollment to ongoing contributions to Declaration of Compliance, we manage all the paperwork and deadlines on your behalf.

Tailored Guidance: Our experts consider your business size, budget, and workforce needs to find the best solution.

Outsourcing to Cashtrak ensures that your workplace pension responsibilities are handled efficiently and professionally, giving you peace of mind while you focus on running your business.

Did You Know? Employers Must Re Enroll Staff Through The Pension Regulator Every 3 Years

Your workplace pension responsibility doesn't stop once your employee enrols or opts-out: The Pension Regulator's short video explains re-enrolment.

Jill Scott, Lioness Legend and owner of Boxx2Boxx Coffee Shop, discusses the importance of strong financial management.

Graeme Bettles' love for dogs and putting them first had him starting Doggo. Xero provides him with a clear picture of the state of his business at any time, from any place

FreeAgent is *FREE if you have a business bank account with Mettle or a business current account with: NatWest, Royal Bank of Scotland and Ulster Bank NI (as long as you retain your bank account.)

See more here: FreeAgent website.

Whether you're just starting out, looking to streamline your existing processes, or planning for future growth, our free business factsheets provide the information you need. From setting up your bookkeeping system to understanding your tax obligations, we've got you covered. Download the resources relevant to your business stage below.

Starting a business can be exciting but overwhelming. This factsheet breaks down the essential components of a business plan, providing practical tips and guidance to help you create a compelling document that will set you up for success.