From 6th April 2019 - Contributions Increase

The minimum contributions for your automatic enrolment workplace pension scheme will increase from 6 April 2019 (also known as phasing.)

Whilst a lot of payroll providers have software that will automatically manage this, it is the employers responsibility to make sure these increases are implemented.

If you don’t have any staff in a pension scheme for automatic enrolment, or if you are already paying above the increased minimum amounts then you don’t need to take any action. Also, if you’re using a defined benefits pension scheme the increases do not apply.

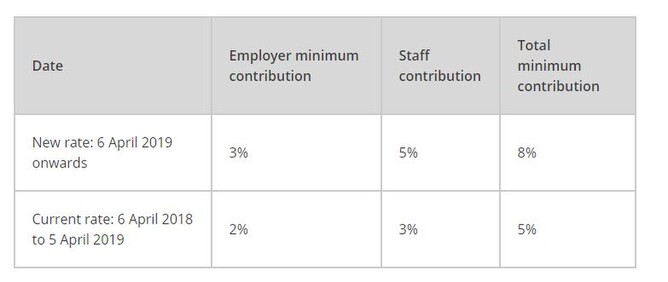

This table below shows the minimum contributions you must pay and the date when they must increase:

Legally, a total minimum amount of contributions must be paid into the scheme. The EMPLOYER must make at least the minimum employer contribution towards this amount and your staff member must make up the difference. An EMPLOYER can cover the total minimum contribution required and therefore the EMPLOYEE won't need to pay nothing.

Questions? Want to know more? Follow this link to The Pensions Regulator website https://www.thepensionsregulator.gov.uk/en/employers/increase-of-automatic-enrolment-contributions

More information on workplace pensions https://www.workplacepensions.gov.uk/employee