The government has announced that Making Tax Digital (MTD) for Income Tax Self Assessment (ITSA) is to be postponed by 2 years AND the income bracket has been raised so only those with an income of £50,000 (not the previous £10,000) will follow the rules in the first phase in 2 years.

MTD for ITSA involves keeping digital records and providing quarterly updates on their income and expenditure to HMRC through MTD-compatible software quarterly filing of the figures using compliant software. The government said ‘the transition to MTD for ITSA represents a significant change to taxpayers and HMRC for how self-employment and property income is reported’ and that the postponement was due to the challenging economic environment that self-employed individuals and landlords are already facing.

This means that from April 2026, self-employed individuals and landlords with an income of more than £50,000 will be required to follow the MTD for ITSA rules.

Those with an income of between £30,000 and £50,000 will need to do this from April 2027.

In addition to this, the government also announced ‘a review into the needs of smaller businesses, particularly those under the £30,000 income threshold. The review will consider how MTD for ITSA can be shaped to meet the needs of these smaller businesses and the best way for them to fulfil their Income Tax obligations.’

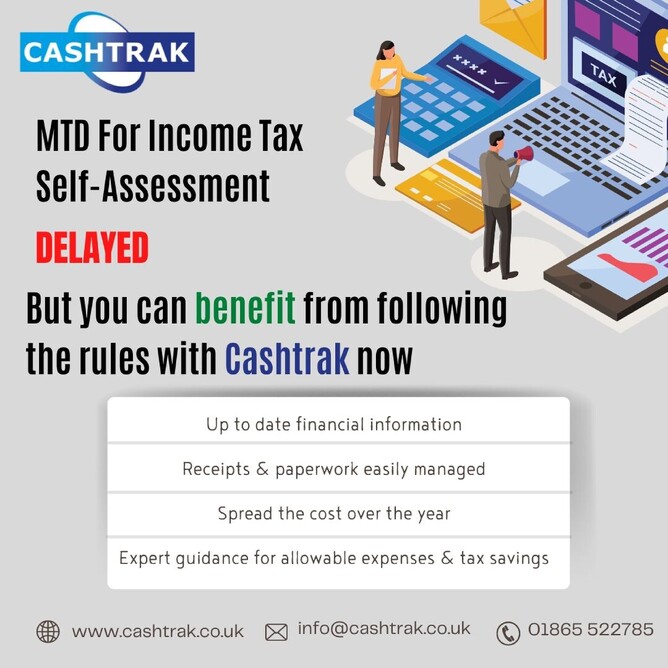

In preparation to the original April 2024 deadline, many of our clients are already following the MTD for ITSA rules which we feel provide many benefits, such as:

- Up to date records allowing you to see an accurate financial position helping you to plan your business and finances

- Easily accessible financial information and reports from anywhere

- Manage your income and expenses

- Quarterly submissions are quicker than annual

In addition to this, the software we offer has receipt capturing ability – take a photo of your receipt on the software as soon as you get it and you can forget about it! Document capturing for invoices, either by uploading them or emailing them, No more scrambling around during the Christmas holidays to find your receipts and invoices. No more losing receipts and losing out on tax savings.

Got a query about expenses? No problem, we can help.

With our new MTD for ITSA service, we charge monthly which not only means you can spread the cost over the year but also this is an allowable business expense and as we are doing the bookkeeping regularly, the submission(s) are a lot simpler for us so the filing the return.

And by the time you will have to follow the rules, you will be an expert in it and will have no bumpy transition!

Contact us to find out how your business will benefit for the MTD for ITSA service, click here to contact us.