VAT-registered businesses will not be able to use their existing VAT online account to submit their VAT returns from Tuesday 1st November 2022 and penalty reforms kick in from 1st January, 2023.

The changes being made are part of the government’s Making Tax Digital (MTD) plan which is meant to make it easier for individuals and businesses to get their tax right and keep on top of their affairs.

HMRC’s states that its ambition is to: “become one of the most digitally advanced tax administrations in the world.” MTD is making fundamental changes to the way the tax system works – transforming tax administration so that it’s:

- more effective

- more efficient

- easier for taxpayers to get their tax right

Online VAT Account

The ability to file VAT returns using the online account ceases on 1st November to ensure all VAT-registered businesses use the new MTD for VAT rules. All VAT-registered businesses must now sign up to MTD and use MTD-compatible software to keep their VAT records and file returns. All of the accounting software we offer is MTD compliant:

- Xero

- Sage

- Quickbooks

- Free Agent

- ClearBooks

And our highly trained, qualified, experienced staff working on our clients not only ensure compliance but save you money, where possible.

Penalty Reform

Currently, HMRC use a default surcharge, this is a civil penalty to encourage businesses to submit their VAT Returns and pay the tax due on time. For VAT periods starting on or after 1st January 2023, the default surcharge will be replaced by new penalties if you submit VAT returns late or pay VAT late. There will also be changes to how VAT Interest is calculated.

Any nil or repayment VAT returns received late will also be subject to late submission penalty points and financial penalties.

Late VAT Returns

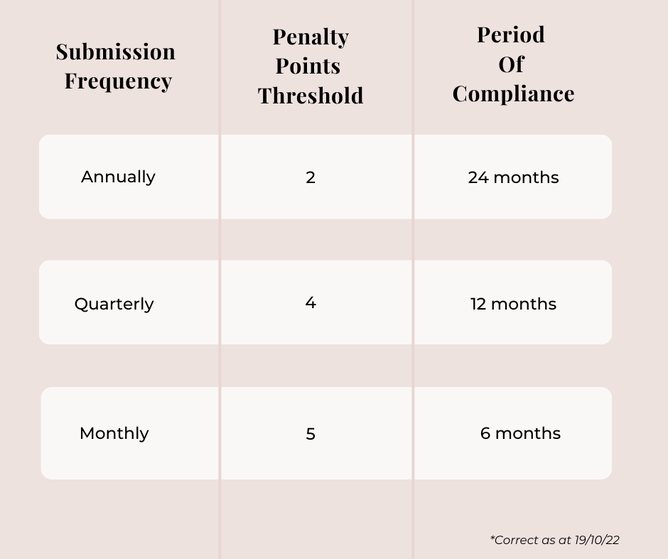

A points based system is being introduced to manage late submission. For each VAT Return you submit late you will receive one late submission penalty point. Once a penalty threshold is reached, you will receive a £200 penalty and a further £200 penalty for each subsequent late submission.

The late submission penalty points threshold will vary according to your submission frequency.

There is an ability to set your points back to zero if you:

- submit your returns on or before the due date for your period of compliance — this will be based on your submission frequency

- make sure all outstanding returns due for the previous 24 months have been received by HMRC

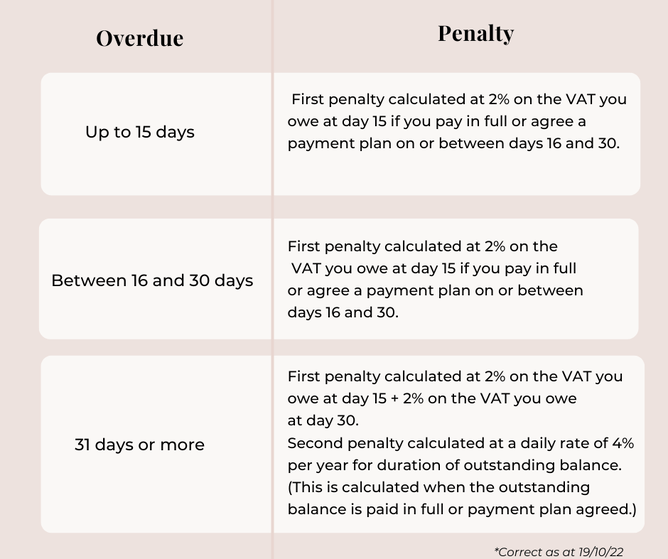

LATE VAT PAYMENTS

The sooner the VAT payment is paid, the lower the penalty rate will be. There are 3 overdue periods being used:

HMRC are allowing a ‘period of familiarisation’ allowing customers to get used to the changes. For the first year (1st January 2023 – 31st December, 2023) first late payment penalties won’t be charged if the VAT payment is made within 30 days of the payment due date.

Late Payment Interest

Late payment interest will be calculated at the Bank of England base rate plus 2.5%. The interest payment will be charged daily, from the day your payment becomes overdue to the day it is paid.

Introduction of Repayment Interest

The current repayment supplement will be withdrawn from 1st January 2023. The Repayment supplement is a form of compensation paid subject to certain conditions if HMRC does not issue a written instruction to pay a return or claim within 30 days of the receipt of the VAT return or claim.

For accounting periods starting on or after 1st January 2023, HMRC will pay you repayment interest on any VAT that you are owed.

This will be calculated from the day after the due date or the date of submission (whichever is later) and until the day HMRC pays you the repayment VAT amount due to you in full.

Repayment interest will be calculated as the Bank of England base rate minus 1%. The minimum rate of repayment interest will always be 0.5% even if the repayment interest calculation results in a lower percentage.

Click here for more information on MTD.

Talk to us about our award winning, compliant VAT return service by clicking here or email us: info@cashtrak.co.uk or call: 01865 522785.