An invoice is an often overlooked and fundamental part of business, it is a document issued by a business to show the goods and/or services provided to a customer. The main aim of the sales invoice is to request payment however there are other functions this serves which are essential to a business.

If both the business and customer are VAT registered, then it is a legal requirement to provide an invoice with certain information. It is important to note that a business can’t reclaim VAT using an invalid invoice or by using a pro-forma invoice, statement or delivery note. It is vital for a business reclaiming VAT that they ensure their suppliers are aware of this. We have come across many suppliers to our clients that are providing invalid invoices which can cause problems:

- Should there be an HMRC inspection, invalid invoices could result in penalties

- It will take longer for the invoice to be processed and it is likely to be queried causing a delay in payment harming cashflow

- It takes longer for bookkeepers to do their work and could result in higher bookkeeping fees in order to manage rogue invoicing suppliers.

Accounting software provides customisable invoices and for the most up-to-date financial information, this is the best option. There are a number of apps that can provide invoices and invoice templates are available online.

What An Invoice Must Include

We list the information required by HMRC on invoices, click on an option to jump to the relevant information.

All Invoices

- Unique identification number

- Your company name, address and contact information

- The company name and address of the customer you’re invoicing

- A clear description of what you’re charging for

- The date the goods or service were provided (supply date)

- The date of the invoice

- The amount (s) being charged

- VAT amount if applicable

- The total amount owed

VAT Invoices

If a business and customer are VAT registered, they need to include more information than non-VAT invoices and must:

- Issue and keep valid invoices

- Keep copies of all the sales invoices you issue even if you cancel them or produce one by mistake

- Keep all purchase invoices for items you buy

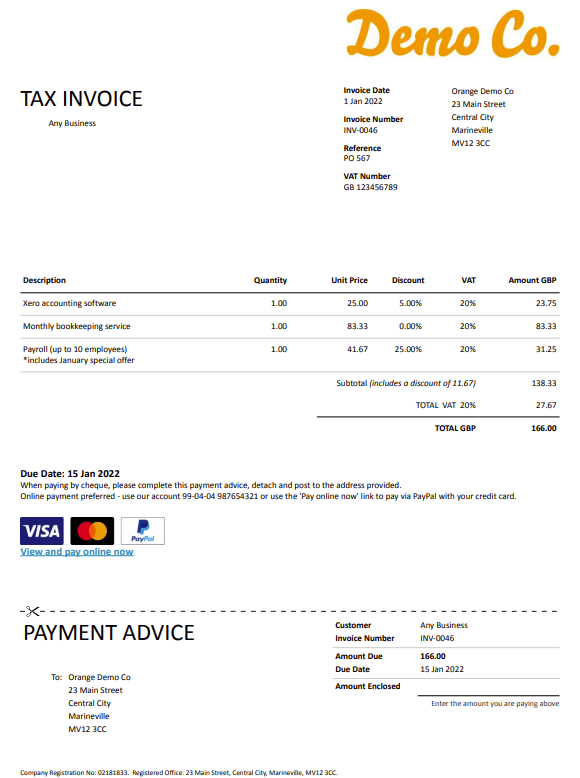

Xero Invoice

Here is an example of a sales invoice raised using Xero. This can be emailed straight from the system with a covering email or saved to PDF. You will see that this invoice gives customers the option to pay online as well as giving them a remittance advice. The online payment option is incredibly useful to the business and customers.

How Can We Help

We offer bespoke solutions to our clients, from sales invoicing, credit control and forecasting to a full, managed bookkeeping service. Whatever your business needs, we can help! Improve your cashflow and efficiency today by taking advantage of our free one hour consultation, contact us here or book online here.