More Information Released On Eligibility And Claim Amounts For 5th SEISS

A fifth grant covering May 2021 to September 2021 will be available to claim through the online service from late July 2021.

The grant is taxable and will be paid out in a single instalment.

If you’re eligible based on your tax returns, HMRC will contact you from mid-July to give you a date that the claims service will be available to you from. It will be given to you either by email, letter or within the online service.

You must make your claim on or before 30 September 2021.

Eligibility:

- You must have traded in the tax years:

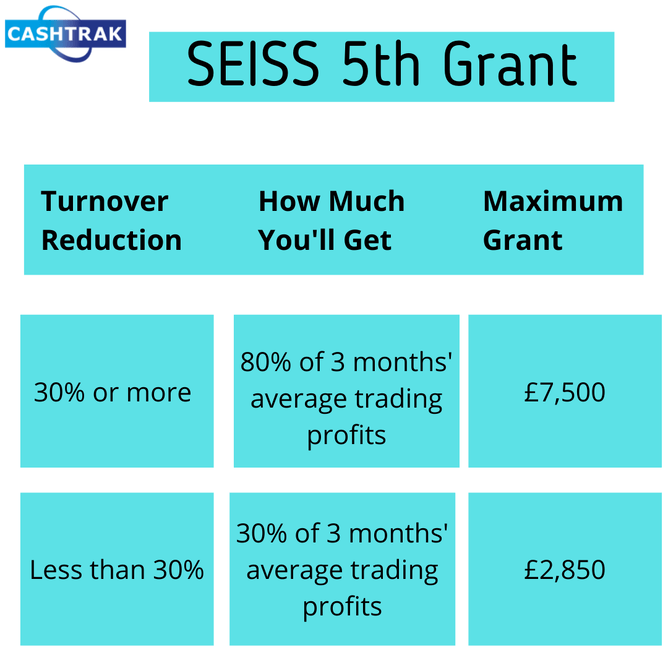

- If your turnover's fallen by 30% or more, you'll be able to claim the full grant worth 80% of three months’ average trading profits, capped at £7,500.

- You traded in 2019 to 2020 and submitted your tax return on or before 2 March 2021

- You traded in 2020 to 2021

You must:

- Intend to continue to trade

- Reasonably believe there will be a significant reduction in your trading profits due to reduced business activity, capacity, demand or inability to trade due to coronavirus from May 2021 to September 2021

You must either:

- Be currently trading but are impacted by reduced demand due to coronavirus

- Have been trading but are temporarily unable to do so due to coronavirus

Tax Returns

To work out your eligibility for the fifth grant, firstly, your 2019 to 2020 Self Assessment tax return will be looked at. Your trading profits must be no more than £50,000 and at least equal to your non-trading income.

If you’re not eligible based on your 2019 to 2020 tax return, the tax years 2016 to 2017, 2017 to 2018, 2018 to 2019 and 2019 to 2020 will then be looked at.

Evidence

You must keep evidence that shows how your business has been impacted by coronavirus resulting in less business activity than otherwise expected.

HMRC expects you to make an honest assessment about whether you reasonably believe your business will have a significant reduction in profits, checks may be carried out on claims and penalties issued for fraudulent claims.

The Fifth Grant Is Different

The amount of the fifth grant will be determined by how much your turnover has been reduced in the year April 2020 to April 2021.

Claim Amount

Guidance for claiming the grant can be found by clicking here.

How We Can Help

We have supported many of our clients with all of the SEISS claims, we have taken on new clients we are supporting and turned around tax returns in record time! We are able to provide ad hoc guidance and support for an hourly rate.

Contact us:

01865 522785