The 2021/22 new tax year starts today. We look at the grants, loans, changes and freezes you need to know about!

Income Tax Self-Assessment Tax Return

You can submit your 2020/21 tax return, now known as an ITSA (Income Tax Self Assessment) any time from now until 31st January 2022. There are numerous benefits of submitting your tax return early, your payment deadline remains as 31st January regardless of when you submit it. Click here for top tax return tips.

Self-Employment Income Support Scheme (SEISS)Grants from the Self-Employment Income Support Scheme (SEISS) made on or after 6th April 2021 are taxed in the year of receipt. This measure will have effect for the tax year 2021 to 2022 and subsequent tax years.

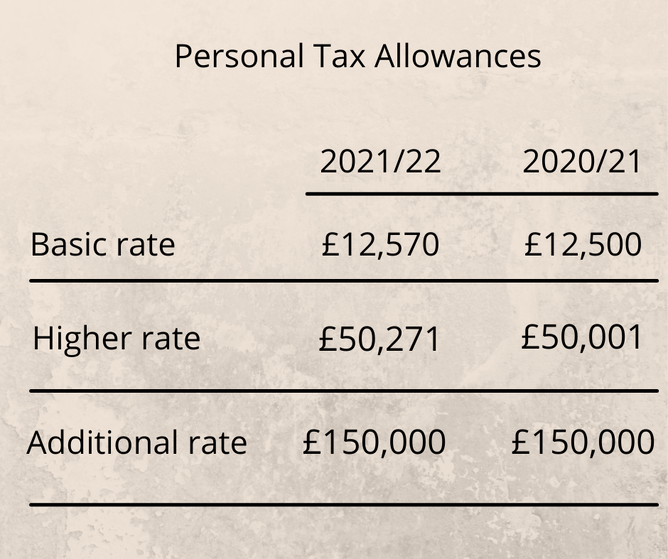

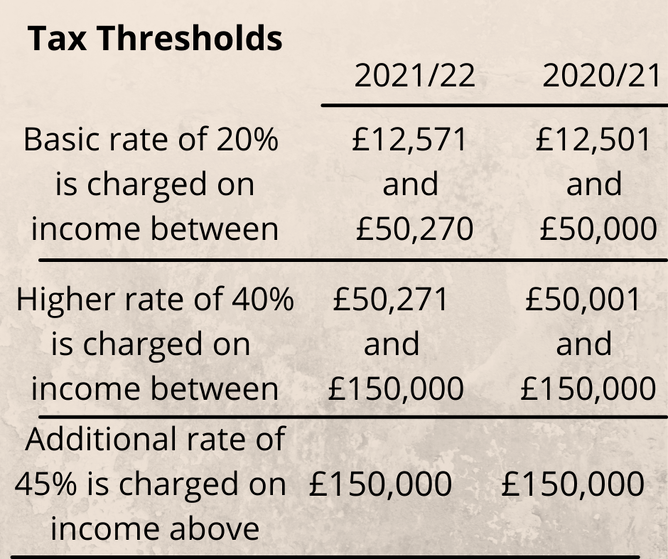

Tax Allowances and Thresholds

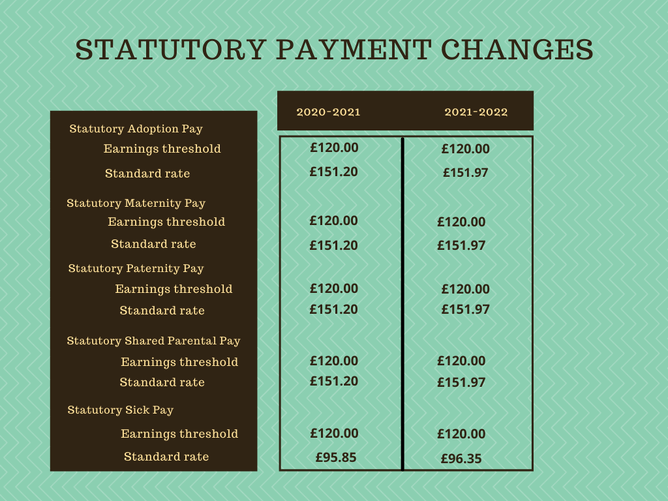

Statutory Payment Changes

Dividend Allowance

Remains unchanged at £2000, Basic-rate taxpayers pay 7.5% on dividends

Higher-rate taxpayers pay 32.5% on dividends

Additional-rate taxpayers pay 38.1% on dividend

Corporation Tax Main Rate

The main rate remains at 19% and rise to 25% for the financial year beginning 1st April 2023.

Super-deduction and 50% First-year Allowances

Between 1st April 2021 and 31st March 2023, companies investing in qualifying new plant and machinery will benefit from new first-year capital allowances.

Under this measure, investments in main-rate assets will be relieved by a 130% super-deduction, whilst investments in assets qualifying for special rate relief will benefit from a 50% first-year allowance.

Vehicle Excise Duty and Levy Rates For Heavy Goods Vehicles (HGVs)

The Vehicle Excise Duty for 2021 to 2022 is suspended.

VAT Registration and De registration

The taxable turnover threshold which determines whether a person must be registered for VAT will remain at £85,000. The taxable turnover threshold which determines whether a person may apply for deregistration will remain at £83,000.

Alcohol Duty

All alcohol duty rates have been frozen.

Inheritance Tax Nil-rate Band and Residence Nil-rate Band

From 6th April 2021 to 5th April 2026 the inheritance tax nil-rate bands will remain at existing levels until April 2026.The nil-rate band will continue at £325,000, the residence nil-rate band will continue at £175,000, and the residence nil-rate band taper will continue to start at £2 million.

This means qualifying estates can continue to pass on up to £500,000 and the qualifying estate of a surviving spouse or civil partner can continue to pass on up to £1 million without being liable for inheritance tax.

What Else

IR 35 rule changes today, read more here.

P60 - employees will receive their P60 following the end of the tax year, what is it and why do you need it? Click here.

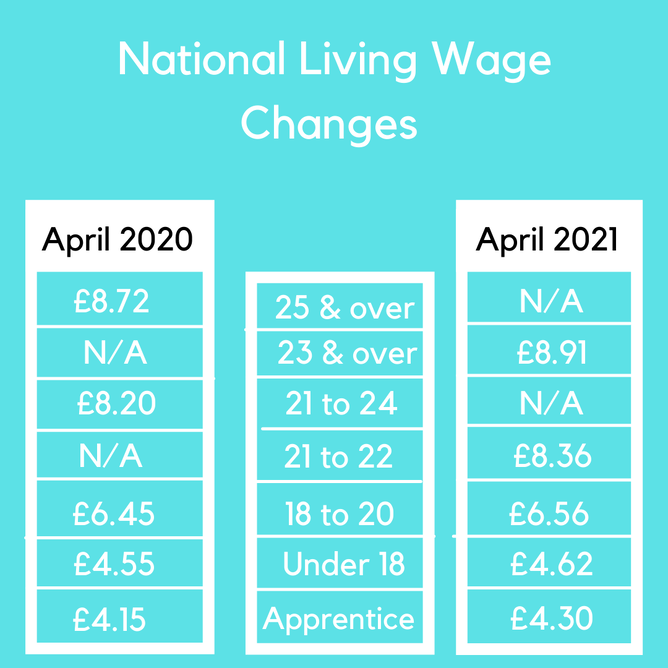

National Living Wage increased earlier this month.

The Recovery Loan Scheme (RLS) was launched today, more on that here.