Allowance Changes

As there was no Autumn Statement, the financial secretary to the Treasury announced a written ministerial statement in the House of Commons with details of the increase of the National Insurance thresholds.

The 2020 Autumn Spending Review confirmed that the personal tax allowance and tax basic rate threshold would increase by 0.5%. This is based on the consumer price index.

This would mean that the personal tax allowance for 2021-22 would increase by £70 from £12,500 to £12,570 and the tax basic rate threshold for 2021-22 would increase to £37,700 from £37,500.

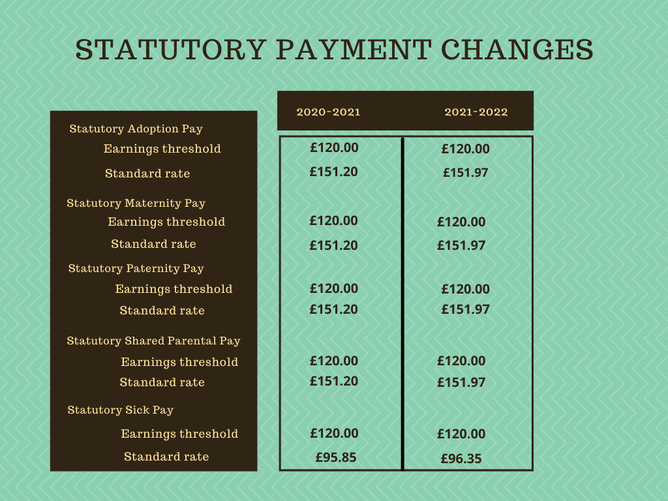

The annual National Insurance threshold for Small Employer’ Relief remains at £45,000. Statutory payments changes remain largely unchanged:

Self-assessment Tax Return Payments

Then of course we need to remind people of the payments for self-assessment, even though the submission deadline extended, payment was not, so interest will be charged still. The late filing fee will be waived in effect is submitted by new deadline of 28th Feb 2021.

Well, technically taxpayers were still obliged to pay their bill by the 31st of January as interest will be charged from February 1st on any outstanding liabilities. HOWEVER, more good news is that taxpayers who can’t afford to pay their tax bill on time can apply online to spread the cost of their tax bill over 12 months.

But in order to set up a payment plan you need to first file your tax return to know your tax liability! (So, “the sooner the better” is the message.) Customers can apply for self-serve Time to Pay by clicking here.. More than 25,000 customers have already availed of this service according to HMRC and all without having to call HMRC directly which is always an added bonus. If your bill is over £30,000 though, or you need longer than 12 months to pay then the advice is to call HMRC (sorry) on 0300 200 3822 to discuss.

Kickstart

The Kickstart Scheme was introduced by DWP (Department for Work and Pensions) for employers in September 2020. This new scheme has created over 120,000 jobs since September 2020 for employees aged between 16 and 24 years old. It is helping young people start their careers as they have been some of the people hardest hit due to economic conditions from the global pandemic.

This scheme allows an employer or group of employers to create new placements for young people and apply for funding from the scheme. The 6 month placements are open to those currently claiming Universal Credit and in danger of long term unemployment. The job placements will allow the participants to gain experience and skills that will assist them in finding employment when they have completed the scheme.

There was a condition previously that an employer had to have a minimum of 30 job placements in order to qualify under this scheme but from 3rd February this threshold will be removed and employers will be able to apply to the Kickstart Scheme without this condition. The closing date for new applicants under this scheme was 28th January, but for employers who want to partake in this scheme they can contact one of the 600 gateway organisations that have been set up such as a Local Authority or Chamber of Commerce. DWP welcomes existing gateways continuing to apply to add more employers and job placements. There is £2 billion available under this scheme and the scheme will run until December 2021.

Under the Kickstart Scheme funding for 25 hours per week for 100% of the relevant National Minimum Wage category in addition to employer National Insurance contributions and employer minimum automatic enrolment pension contributions is available per participant. Funding of £1,500 for setup, support and training costs per placement is also paid. This scheme is available to employers in England, Scotland and Wales.

The job placements must:

- Be a minimum of 25 hours per week, for 6 months

- Pay at least the National Minimum Wage or National Living Wage for the person’s age category

- Only require basic training

Every application has to show how the employer will aid the participants grow their skills and experience.

Development options could include:

- Providing support to the participants to seek long-term work, including career advice and setting goals

- Support with CV and interview preparations

- Developing their skills in the workplace such as timekeeping, attendance and teamwork

For further information or help, contact: info@cashtrak.co.uk.