Unfortunately, we are well aware of criminals preying on individuals in all walks of life. With the tax return deadline just over 8 weeks away, HMRC are warning self-assessment customers to take care to avoid being caught out by scammers.

The tax return department issues thousands of text messages and emails as part of its annual Self Assessment tax return push. In the last 12 months, HMRC has responded to more than 846,000 referrals of suspicious HMRC contact and reported over 15,500 malicious web pages to internet service providers to be taken down. Almost 500,000 of the referrals offered bogus tax rebates.

Many scams target customers to inform them of a fake ‘tax rebate’ or ‘tax refund’ they are due. They use language to convince them to hand over personal information, including bank details, to claim the ‘refund’. This information is then used to access customers’ bank accounts, tricking them into paying fictitious tax bills or sell on their personal information to other criminals.

HMRC have advised:

“If someone calls, emails or texts claiming to be from HMRC, offering financial help or asking for money, it might be a scam. Please take a moment to think before parting with any private information or money.”

HMRC is also warning the public to be aware of websites that charge for government services (such as call connection sites) that are in fact free or charged at local call rates. Other companies charge people for help getting ‘tax refunds’. You can claim a tax refund for free by logging on to your personal tax account, access your personal self-assessment tax return account here.

HMRC has a dedicated Customer Protection team that identifies and closes down scams but they ask the public to recognise the signs to avoid becoming a victim. HMRC regularly publishes examples of new scams to help customers recognise scams, you can view scam examples by clicking here.

A further way to help spot a scammer is to check the contact details against HMRC genuine contact details, click here for HMRC genuine contact details.

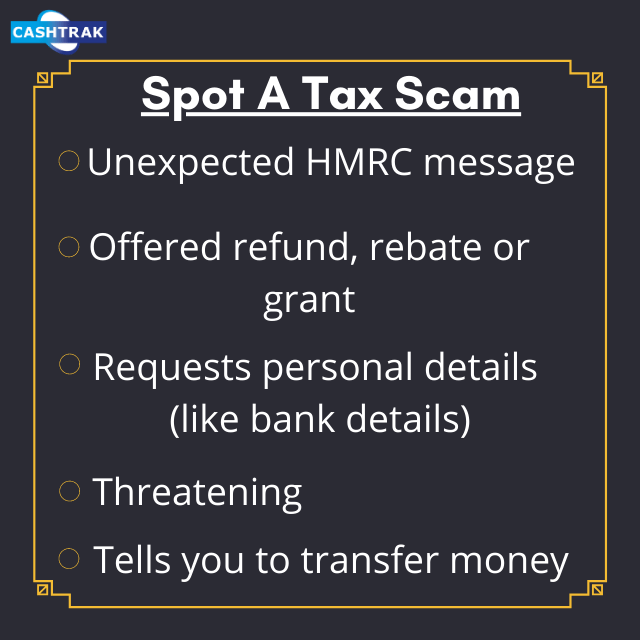

Ways To Spot A Tax Scam

It could be a scam if it:

- is unexpected

- offers a refund, tax rebate or grant

- asks for personal information like bank details

- is threatening

- tells you to transfer money.

In the 12 months to October 2020, HMRC:

- responded to 846,435 referrals of suspicious HMRC contact from the public. More than 495,937 of these offered bogus tax rebates

- responded to 306,219 reports of phone scams, an increase of 47% on the previous 12 months.In October 2020, HMRC received reports of 44,543 phone scams

- worked with the telecoms industry and Ofcom to remove more than 3,387 phone numbers being used to perpetrate HMRC-related phone scams

- reported 15,518 malicious web pages to internet service providers to be taken down

If you’re concerned about falling victim to a potential scam, remember:

Stop:

- Take a moment to think before parting with your information or money.

- Don’t give out private information or reply to text messages, and don’t download attachments or click on links in texts or emails you weren’t expecting.

Challenge:

- It’s ok to reject, refuse or ignore any requests - only criminals will try to rush or panic you.

- Search ‘scams’ on here for information on how to recognise genuine HMRC contact and how to avoid and report scams.

Protect:

- Forward suspicious emails claiming to be from HMRC to phishing@hmrc.gov.uk and texts to 60599.

- Contact your bank immediately if you think you’ve fallen victim to a scam, and report it to Action Fraud (the Police's fraud arm) by clicking here.

Other Ways To Report

If you’ve been the victim of fraud, contact your bank immediately and please report it to Action Fraud or by calling 0300 123 2040.

Customers can report suspicious activity to HMRC at phishing@hmrc.gov.uk and texts to 60599. They can also report phone scams online on here.