As we wrap up a week of celebrating global bookkeepers, we look in to bookkeeping as a career.

The number of private sector businesses in the UK at the start of 2020 was estimated to be 6 million, made up of:- 5.94 million small businesses (0 to 49 employees),

- 36,100 medium-sized businesses (50 to 249 employees)

- 7,800 large businesses (250 or more employees,

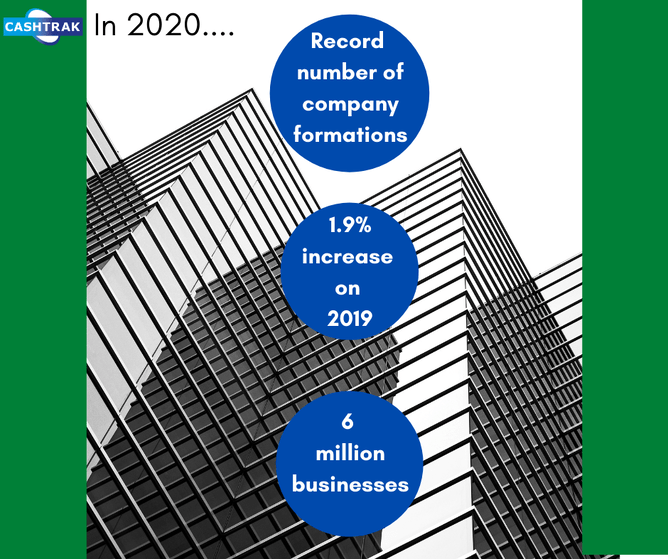

This was an increase of 1.9% (113,000 more) businesses compared with 2019. 2.7 million private sector businesses were recorded as registered for VAT or PAYE, 44% of the estimated total population.

Despite the coronavirus pandemic (or, perhaps because of it?) company formations in England from January 2020 – September 2020 are 9.5% higher than the same period last year. September 2020 saw 29% year on year growth, the fourth month in a row. A record number of businesses formed in June this year, business formations dropped year-on-year by 19% in March, 29% in April, and 3% in May, before growing 47% in June.

With such a boom in business formations, there is no better time to become a qualified bookkeeper. Bookkeepers play a valuable and vital role in the financial success of businesses, being in a position to see the early warning signs of possible financial difficulties.

Although businesses, especially start-ups may think that they are saving money by undertaking the bookkeeping themselves, it could be an expensive mistake. Involving a bookkeeper at the beginning allows a scalable service, set up correctly and compliant rather than at a later point with the possibility of penalties and having to have a bookkeeper spend time unpicking errors which is time consuming, stressful and costly.

Bookkeepers can be employed directly by a business, work as part of a bookkeeping practice or be a sole trader, on their own. A career in bookkeeping can be ideal for flexible working, cloud software allows you to work from anywhere with an internet connection. Well managed workloads allows for flexible hours which is great for working around a family life or pursuing past times or travel. If you chose to work from home then overheads are minimal. Flexible working allows a healthy work-life balance, supporting mental health and productivity.

A bookkeeper starting up on their own has the potential to employ staff and grow their business. There is lots of support and resources available through the Institute Of Certified Bookkeepers and the Federation Of Small Businesses amongst others.

Surprisingly, bookkeepers do not need to be qualified however it is not recommended to practice without qualifications, the Institute Of Certified Bookkeepers provide easy to access courses and exams through their website or through a course provider, allowing students to work at their own pace. Once qualified, there are further courses and exams that can be taken to qualify to higher levels and/ or to work on other areas in bookkeeping such as payroll and self-assessment tax return whilst working in practice.

Another benefit often cited of being a bookkeeper is being your own boss, whilst this is a benefit, setting up a practice should not be under estimated. The Institute Of Certified Bookkeepers provide valuable resources, instructions and support in setting up but the work needed to do this should not be under estimated. A particular time consuming part of having your own practice is the anti-money laundering side of the requirements. It should be pointed out that this is HMRC requirements, the Institute Of Certified Bookkeepers provide the tools and resources to be compliant. This is an ongoing process and should be taken very seriously and be a priority of your practice.

Dependant on qualifications and business turnover, a bookkeeper is able to undertake all the financial work needed for a small business, avoiding the need for an accountant, saving the business money. Where an accountant is used by a business, a bookkeeper could be valuable for saving money – the better condition the books are in, the less time an accountant spends on the work and the less a business is charged.

With the internet and social media, marketing is easier and harder than ever! Getting practice out there is fairly easy and low cost but getting noticed can take time and money. Again, the Institute of Certified Bookkeepers provide help and support with marketing and a simple Google search provides endless options.

There are regular Institute Of Certified Bookkeepers branch meetings across the country allowing extra support and advice on everything from exams to running a practice which is an invaluable support resource for us all.

Being a bookkeeper offers flexibility and opportunities, with the Institute Of Certified Bookkeepers as a governing body, a bookkeeper will never be on their own. Now is the time to make the move - a rewarding and worthwhile career is waiting for you.

Statistics from:www.gov.uk

www.fsb.org.uk

www.centreforentrepreneurs.org