More Rules For Employers To Understand The New Schemes

Please note, following the announcement on 31st October by Boris Johnson of the new England lockdown set to last a month, the Coronavirus Job Retention Scheme (CJRS) has been extended for a month and the Job Support Scheme (JSS) detailed below will commence once the Furlough Scheme extension finishes.

What Is The Job Support Scheme (JSS) Open And Closed?

The Coronavirus Job Retention Scheme (CJRS) also referred to as furlough ends on 31st October, 2020 and is being replaced by the Job Support Scheme (JSS) from 1st November 2020.

The Job Support Scheme (JSS) has been separated in to two to cover businesses that are legally required to close (JSS Closed) and businesses with reduced demand (JSS Open.) A business is able to use both schemes at the same time if necessary (if offices are in different restriction levels across the country) and can move between the two.

We Take A Look At What is Involved In Both Schemes

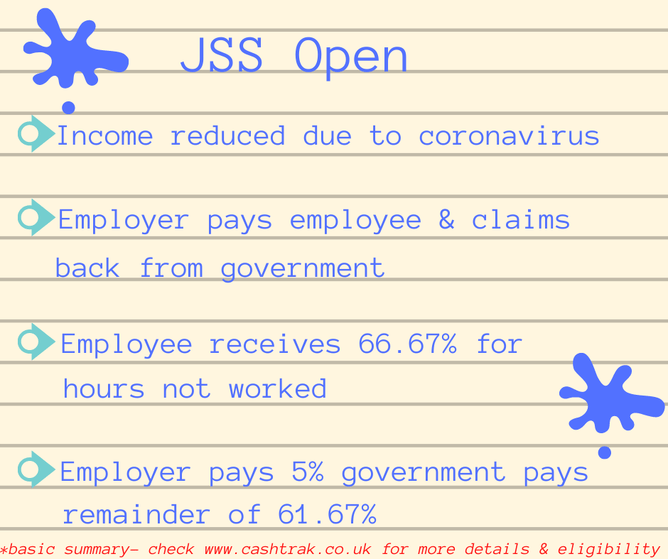

Employers facing decreased demand (JSS Open)

Businesses that are safely able to trade but find that there is reduced demand and need support to keep their employees are able to use this scheme.

- Employee will need to work a minimum of 20% of their usual hours

- Employer pays employee as normal

- Employee receives 66.67% of their normal pay for hours not worked (through contributions from the employer and government)

- Employer pays 5% of reference salary for the hours not worked, up to a maximum of £125 per month (they can pay more if they want)

- Government pays the remainder of 61.67%, of reference salary for the hours not worked up to a maximum of £1,541.75 per month.

This scheme ensures employees continue to receive at least 73% of their normal wages, where they earn £3,125 a month or less.

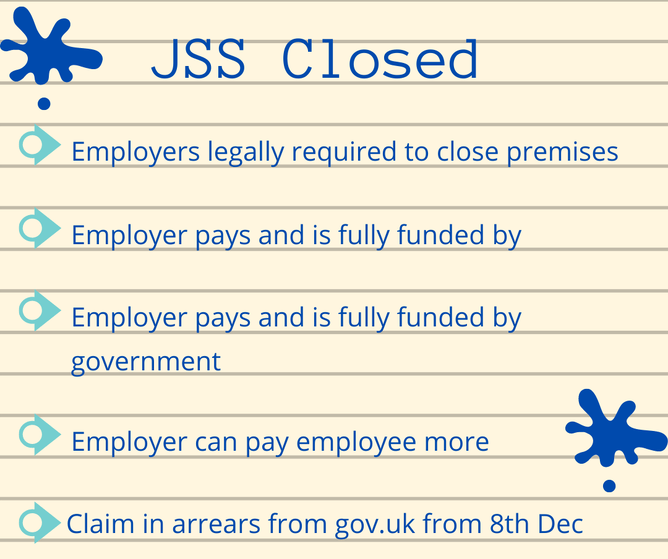

Employers who are legally required to close their premises (JSS Closed)

This scheme is open to businesses that have legally been required to close their premises as a direct result of the coronavirus restrictions. This is aimed at supporting wage costs of employees to protect them from redundancy.

- Employee receives two thirds of their normal pay

- Employees may also be entitled to additional financial support, including Universal Credit

- Employer pays and is fully funded by government to a maximum of £2083.33 per month (employer can pay more if they want)

- Employees may also be entitled to additional financial support, including Universal Credit

Further Information

- The scheme runs from 1st November, 2020 for 6 months, ending 30th April, 2021

- The terms will be reviewed in January

- Employers can claim in arrears from 8th December, 2020

- Neither employer or employee needs to have used the Coronavirus Job Retention Scheme (CJRS) to benefit from the JSS schemes

Who Can Claim Both JSS Open and Closed:

- Employer has enrolled for PAYE online

- Employer has a UK, Channel Island or Isle of Man bank account

- All employers and employees that meet the criteria above

- Employers can claim JSS Open and JSS Closed at the same time for different employees

- Employer cannot claim for a single employee under both schemes at the same time

- Employee was on PAYE payroll between 11.59pm on 6th April 2019 and 23rd September, 2020 (This means an RTI Full Payment Submission notifying payment in respect of that employee must have been made to HMRC at some point from 6 April 2019 up to 11:59pm 23 September 2020.)

- Employees can be on any type of contract, including zero hours or temporary contracts

- Agency workers are regarded as employees of an employment agency for the purposes of this scheme, provided they are employees for Income Tax purposes

Who Can Claim JSS Open:

In addition to the above:

- Employer with 250 or more employees on 23 September 2020 has undertaken a Financial Impact Test (see below) demonstrating their turnover has remained equal or fallen to show they have been adversely affected due to coronavirus

- Employer with less than 250 employees on 23 September 2020 is not required to satisfy the test

- Some, or all, of their employees are working reduced hours - employees must still be working for at least 20% of their usual hours

Who can claim JSS Closed:

In addition to who can claim both JSS Open and Closed:

- Business premises at one or more locations legally required to close as a direct result of coronavirus restrictions set by one or more of the four governments of the UK

- Businesses premises required to close by local public health authorities as a result of specific workplace outbreaks are not eligible for this scheme

- Employers are only eligible to claim for periods during which the relevant coronavirus restrictions are in place

To Note

- Fully publicly funded organisations should use that money to pay their employees, NOT the JSS

- Partially publicly funded organisations can use the JSS for the proportion of their revenue disrupted by coronavirus although these organisations should contact their sponsor department or respective administration for further advice before accessing the scheme

- The schemes do not cover National Insurance contributions (NICs)

- Employees will be able to undertake training voluntarily in non-working hours. Where time spent on training attracts a minimum wage entitlement in excess of the grant payment, employers will need to pay the additional wages

- Government expects that large employers (250 or more employees) and their corporate groups using the scheme will not make capital distributions whilst claiming the JSS including:

- dividend

- charge

- free or other distribution

- any equivalent payment that a partnership may make to its partners

Claiming

Employers will be able make their first claim from 8 December 2020 on GOV.UK covering salary for pay periods ending and paid in November. Subsequent months will follow a similar pattern, with the final claims for April being made from early May. Agents who are authorised to do PAYE online for employers will be able to claim on their behalf.

Financial Impact Test For Large Employers Claiming JSS Open

HMRC require that ‘large’ employers (employing 250 or more staff on 23 September 2020) complete a Financial Impact Test to provide evidence that their turnover has remained equal or decreased compared to the previous year, then they will qualify. This test only needs to be taken once before the employers first claim for the Job Support Scheme.

These businesses who are VAT registered are required to compare the total sales figure on their VAT returns, these figures are dependant on whether VAT submissions are quarterly, monthly, less frequently, or businesses that are part of a VAT group. Registered, UK charities or exempt from such registrations with 250 or more employees are not be required to carry out the test and are eligible for this scheme.

Businesses Submitting Quarterly VAT Returns

Need to compare the total sales figure on their VAT return, due to be filed and paid between 31 August 2020 and 7 November 2020, with the total sales figure from the same quarter in 2019 (figure recorded in box 6 of the VAT return), capturing the total value of sales and all other outputs excluding any VAT. This box captures all sales, whether subject to VAT or not.

Businesses Submitting Monthly VAT Returns

Need to compare the three consecutive months which are due to be filed and paid by 7 November 2020 with the same period in 2019.

Businesses Submitting VAT Returns Less Frequently

Need to compare the three consecutive months which are due to be filed and paid by 7 November 2020 with the same period in 2019 but will need to have submitted a VAT return between 31 August 2020 and 7 November 2020 to be eligible.

Businesses Submitting VAT Returns As Part Of A VAT Group

Must use the turnover figures for the VAT group for this calculation.

Businesses Not VAT Registered

HMRC is yet to announce the rules.

In Conclusion

Unfortunately, the rules and requirements can be complicated and HMRC are likely to inspect businesses claiming through these schemes to ensure compliance which means that accurate calculations, records and justifications must be kept. Cashtrak, as an experienced payroll bureau understand each of the different situations covered by these schemes including variable pay and hours and will be providing our clients with the calculations as well as accurate records free of charge as we did with the Coronavirus Job Retention Scheme despite the large amount of time spent on some of the more complicated calculations. As we are calculating these figures and processing payroll on a regular basis for a wide range of different clients, industries and workforces we are able to do this much more efficiently and effectively than most.

Cashtrak's payroll service starts at just £45 + VAT per month which our clients agree is a small price to pay for giving them time to focus on their business and the assurance they are HMRC compliant. Contact us at info@cashtrak.co.uk/ 01865 522785 or click here to go to our payroll page which shows our value added service.