Furlough rules are changing:

From 1 July:

- employers can bring back to work employees that have previously been furloughed for any amount of time and any shift pattern, while still being able to claim CJRS grant for their normal hours not worked.

- employers will be able to agree any working arrangements with previously furloughed employees.

• When claiming the CJRS grant for furloughed hours; employers will need to report and claim for a minimum period of a week.

• This is a minimum period and those making claims for longer periods such as those on monthly or two weekly cycles will be able to do so.

• To be eligible for the grant, employers must agree with their employee any new flexible furloughing arrangement and confirm that agreement in writing.

• Employers can claim the grant for the hours their employees are not working calculated by reference to their usual hours worked in a claim period. Further details will be included in future guidance.

• Employers will need to report hours worked and the usual hours an employee would be expected to work in a claim period.

• For worked hours, employees will be paid by their employer subject to their employment contract and employers will be responsible for paying the tax and NICs due on those amounts.

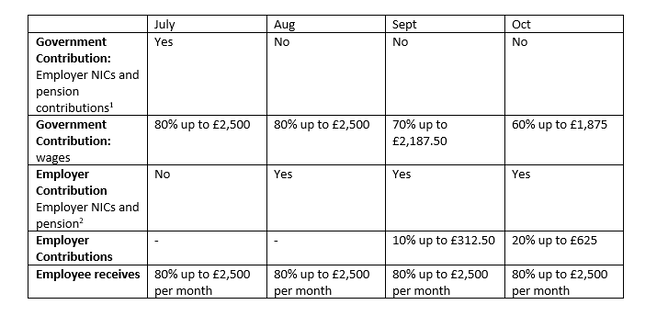

Employer costs:

From August 2020, the level of the grant will be slowly tapered to reflect that people will be returning to work:

• In June and July, the government will pay 80% of wages up to a cap of £2,500 as well as employer National Insurance Contributions (ER NICS) and pension contributions for the hours the employee doesn’t work. Employers will have to pay employees for the hours they work.

• In August, the government will pay 80% of wages up to a cap of £2,500 and employers will pay ER NICs and pension contributions for the hours the employee does not work.

• In September, the government will pay 70% of wages up to a cap of £2,187.50 for the hours the employee does not work. Employers will pay ER NICs and pension contributions and 10% of wages to make up 80% total up to a cap of £2,500.

• In October, the government will pay 60% of wages up to a cap of £1,875 for the hours the employee does not work. Employers will pay ER NICs and pension contributions and 20% of wages to make up 80% total up to a cap of £2,500.

The cap will be proportional to the hours not worked.

As with the previous scheme, employers are still able to choose to top up employee wages above the scheme grant at their own expense if they wish.

An early assessment of CJRS claims suggest that around 40% of employers have not made a claim for employer NICs costs or employer pension contributions and so will be unaffected by the change in August if their employment patterns do not change.3

• Indicative analysis of claims from large businesses suggests that around 25% of CJRS monthly claims are below the threshold where employer NICs and automatic enrolment pension contributions are due, and so no employer contribution would be expected for these payments to furloughed employees in August.4

• Early analysis of CJRS claims suggests the equivalent wage on the average CJRS claim is around £1,380 per month. Requiring firms to pay the Employer NICs costs and pension contributions on the CJRS payments will introduce a cost of £69 per month on this figure5. This equates to 5% of total gross employments costs6 the employer would have incurred had the employee not been furloughed. This percentage will vary according to the wages of the employee who has been furloughed.

• The employer cost per month on the average grant will rise to £207 in September and to £345 in October representing 14% and 23% of gross employment cost, respectively.

1,2 Government contribution covers employer NICs and pension contributions (up to an amount equivalent to the minimum automatic enrolment employer pension contribution) calculated on 80% of wages up to £2,500 a month.

3 This estimate is based on HMRC analysis of CJRS administrative scheme level claims management information.

4 This estimate is based on HMRC analysis of an employee level claims management information. This information only covers employees furloughed from large businesses.

5 This assumes the employee is not an apprentice, is over 21 and the firm is not benefiting from the Employment Allowance.

6 Gross employment costs are the full gross wage, Employer National Insurance contributions and minimum pension contributions on this wage.