HMRC announced on 16th March 2020 that they will no longer automatically send paper returns to encourage customers to use the online service to cut the unnecessary use of paper to be more environmentally friendly.

Last year, 94% of HMRC’s customers filed their returns online and HMRC recently saw a 110% increase in customers registering to communicate digitally. Last year HMRC automatically sent out more than 500,000 returns.

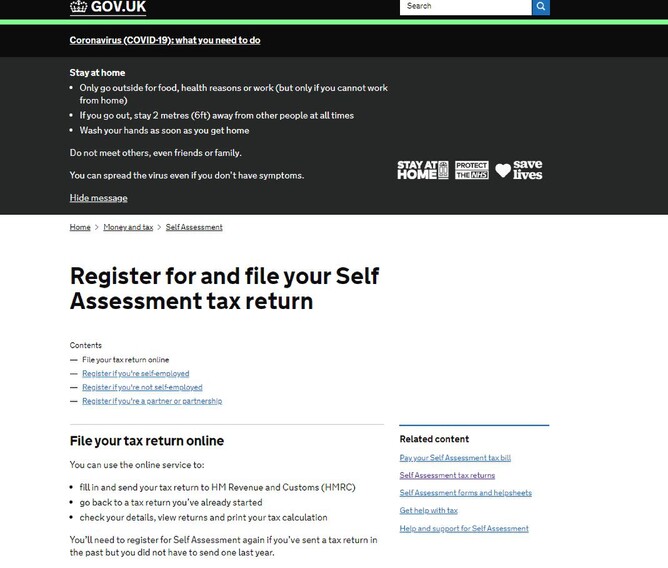

From April, taxpayers who have filed on paper in the past will now receive a short reminder. If they want to file on paper, they can download a blank version online call HMRC to request one.

The reminder from HMRC ‘notice to file’ will advise that HMRC intend to communicate digitally and provide information about managing tax affairs through taxpayers Personal Tax Accounts.

As taxpayers visit their Personal Tax Account online HMRC will request their agreement to communicate digitally by default and, if they consent, subsequent communication, including statutory notices, will be provided digitally.

Where HMRC can identify taxpayers, whose personal circumstances mean they cannot file online, they will continue to receive a blank paper return.

There are many advantages of filing online other than being environmentally friendly, it’s easy, secure and available 24 hours a day. Customers can also sign up for email alerts and online messaging. The tax return does not have to be done all in one go customers can stop, save what they’ve done, and pick up where they left off later as well as being able to easily locate previous years returns.

HMRC are prioritising digitisation however they are committed to giving taxpayers the ability to choose what’s best for them, so those who want to file a paper return can still do so.

There will be a small number of taxpayers (between 1% and 3%) for whom the nature of their return or their personal circumstances means that filing digitally will not be an option in 2020 to 2021. Where we can identify them in advance, we will provide them with a paper return in April 2020.

These efforts are part of a larger HMRC initiative to reduce unnecessary paper with Annual Tax Summaries now also moving to taxpayers’ Personal Tax Accounts. The summaries of what PAYE taxpayers have paid were posted to 22 million people last year. Paper will also be reduced when HMRC stops providing more than three million blank P45s and 11 million P60s in April. The vast majority of employers already use their existing HMRC, free or commercial software to produce P45s and P60s for their employees.