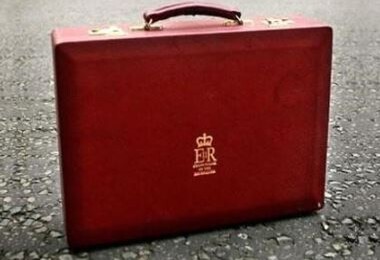

The March 2020 Budget was Expansive and Optimistic

Chancellor Rishi Sunak had a difficult task giving his first Budget at a time of such a challenging economic background, which was made worse by the impact of the Coronavirus.

The government needed to fulfil its election promises, so the emphasis was on spending plans as they sought to fulfil the promises, to substantially increase infrastructure expenditure and to recover from the negative impact of the Coronavirus. These announcements were supported by the Bank of England, with the cut in the base rate from 0.75% to 0.25% announced that morning, the base rate of 0.25% takes borrowing costs back to the lowest level in history to encourage spending.

Unfortunately, there are relatively few changes that will have a direct or indirect impact your tax.

National Insurance and Income Tax

What will be welcomed by employees and the self-employed respectively is an increase in the National Insurance primary threshold limit to £9,500 (from £8,632) from 6th April 2020. Currently, the threshold sees them paying contributions once they earn £166 a week. The Income Tax personal allowance remaining at £12,500.

According to independent economists at the Institute for Fiscal Studies (IFS), that will mean 500,000 people will no longer have to pay this tax. Those still paying will save up to £85 a year on average. The chancellor said it would be just over £100 a year, but that calculation may not include the self-employed.

The IFS states that 8% of the gains go to the poorest 20% of working households, so it is those on a decent income who may benefit the most. However, those working in a number of low-paying part-time jobs could see their take-home pay increase significantly.

VAT

Most women will be relieved to hear that the ‘tampon tax’, the 5% VAT on women's sanitary products, is to finally be scrapped.

VAT on digital publications, including newspapers, e-books and academic journals to be scrapped from December.

Statutory Sick Pay

Specific personal finance changes include the chancellor saying all of those advised to self-isolate, even if they do not show symptoms, are to receive statutory sick pay if eligible.

UK employees have already started to get statutory sick pay from the first day off work, to help contain Coronavirus. This is paid by the employer, but smaller businesses with fewer than 250 employees can reclaim the cost of paying sick pay for the 14 days of isolation.

Those who are not eligible for sick pay, particularly the self-employed, will be able to claim Employment and Support Allowance (ESA) from day one of "illness" rather than day eight.

ESA is paid to those who are too sick to work, provided they meet certain conditions. It is worth £73.10 a week, or £57.90 for the under 25s. The complexity of this benefit may mean this change is unlikely to affect a lot of people.

Councils will also have access to a hardship fund to help vulnerable people in their area.

Pensions

The full, new state pension will increase by 3.9% from £168.60 a week to about £175.20 in April. However, most pensioners get the older basic state pension, which is also going up by 3.9%, from £129.20 to £134.25 per week. They could be eligible for a Pension Credit top-up

There have been changes to pensions tax for higher earners, the highly complicated way in which high earners are taxed is set to change. Basically, tax relief on pensions becomes less generous if annual income exceeds £150,000 a year. This has become a problem as the income cap includes the value of pensions earned, not just salary.

Some doctors have been refusing to work extra hours (and earning more) because they were being landed with much bigger tax bills.

They, and other high earners, are currently affected by this restriction once income goes over £110,000. The government has promised this may only kick in once annual income exceeds £200,000.

The tapered annual allowance for pensions has been a hot topic for high earners, especially members of the NHS Pension Scheme. We had expected the chancellor to increase the level at which the tapered allowance first applies, but not to the extent that he did. He increased the threshold and adjusted income levels by £90,000: meaning that no one with income under £200,000 will now be subject to the taper and will have a £40,000 annual allowance. However, it isn’t all good news: the minimum that the annual allowance can taper down to will now be £4,000 rather than £10,000. If you have previously ceased or reduced contributions to a pension scheme, this may mean there is now more scope to reconsider this decision. You should contact your financial advisor for more information.

Business Rates

Business rates in England will be abolished for firms in the retail, leisure and hospitality sectors with a rateable value below £51,000.

Working Age Benefits

Many working-age benefits which had been frozen for four years will rise in line with the increasing cost of living:

- Jobseeker's Allowance

- Employment and Support Allowance

- Some types of Housing Benefit

- Child Benefit

They will be going up by 1.7%. So, for example, child benefit for the eldest child will go up from £20.70 to £21.05 per week

National Living Wage

Employers will have to pay those aged 25 and over will the National Living Wage of £8.72 an hour, a rise of 6.2%, with younger workers also getting more from their employers.

IR35

The controversial IR35 means many self-employed people face a higher tax bill from April, when the so-called IR35 rule is extended to the private sector. That could mean thousands of contractors and freelancers will pay more tax. For those unsure of IR35 - it is a piece of legislation that allows HMRC to collect additional payment where a contractor is an employee in all but name. If a contractor is operating through an intermediary, such as a limited company, and but for that intermediary they would be an employee of their client, IR35 kicks in.

Inheritance Tax

The gradual process allowing people to pass on property to their descendants free from some inheritance tax enters its final stage of introduction. It will reach its target by 2021.

Entrepreneurs’ Relief

There was significant pre-Budget speculation around Entrepreneurs’ Relief, which grants a 10% tax rate on capital gains realised from the disposal of a qualifying interest in a qualifying business, up to a lifetime gains limit of £10 million. While the relief will remain, the lifetime limit will reduce to £1 million.

Investments

Parents keen to make tax-efficient provision for their children will welcome the increase in the annual limit for Junior ISA subscriptions to £9,000 (from £4,368) for the 2020/21 tax year. For investors, the main change of note was the increase in the annual Capital Gains Tax exemption to £12,300 (up from £12,000) for the next tax year. The (tax-free) dividend allowance remains at £2,000. Taken together, these reliefs increase the tax attractions of an investment in unit trusts, subject to appropriate limits.

Corporation Tax

It was confirmed that the previously announced reduction in Corporation Tax to 17% would not be going ahead. The rate remains at 19%, which is still relatively low.

Tax Relief

Ahead of the Budget, there was considerable discussion about the possibility of change to pensions tax relief and Inheritance Tax, but nothing was forthcoming. However, it’s worth remembering that this is the first of two Budgets this year. The next is due to take place in the autumn, following the spending review.

Tax Avoidance

As we have come to expect from Budgets, there are measures to combat aggressive tax avoidance. The chancellor adhered to an unwritten budget convention by pledging to recoup around £1bn a year with a clampdown on tax avoidance and evasion. The programme includes measures to pursue promoters of aggressive tax avoidance schemes and “investment in additional compliance officers and new technology for HMRC”.

Employment Allowance

The employment allowance will increase to £4000 for the tax year 2020-21, and employment of ex-service men and women will mean a 1 year National Insurance holiday

Home Working

The basic allowance for home working has increased from £4 to £6 per week.

Everything Else

- Fuel duty to be frozen for the 10th consecutive year

- Duties on spirits, beer, cider and wine to be frozen

- Tobacco taxes will continue to rise by 2% above the rate of retail price inflation

- This will add 27 pence to a pack of 20 cigarettes and 14 pence to a packet of cigars

- Business rate discounts for pubs to rise from £1,000 to £5,000 this year

- Firms eligible for small business rates relief will get £3,000 cash grant

- Plastic packaging tax to come into force from April 2022

- Total investment in flood defences in England to be doubled to £5.2bn over next five years

Any questions, please contact us - info@cashtrak.co.uk